Kinship with

the Deceased

– A link by adoption is considered to be equal to that of a link by blood.

– A non-married partner is classified as a non-related beneficiary, as are the children of the non-married partner.

There are a lot of rules specific to each Comunidad Autonoma related to this issue. These are mainly in order to assimilate married and non-married couples, and depend on whether the union in question was constituted according to the rules of that Comunidad Autónoma and whether it was included in its register of non married couples.

– IN THIS CALCULATOR, YOU DON’T NEED TO DISTINGUISH GROUP OR GRADE IN ORDER TO CALCULATE INHERITANCE TAX. IT IS ALREADY DONE. THE FOLLOWING IS JUST FOR INFORMATION BECAUSE THE TERMS GROUP AND GRADE SOMETIMES APPEAR IN THE REGULATION.

For inheritance tax purposes there are four groups into which the relatives can be classified according to the closeness of the relationship.

Beneficiaries fall into one of four groups depending on the closeness of their relationship to the deceased. ( Grade)

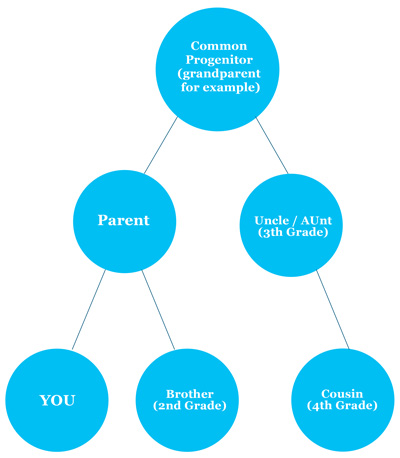

– The Grade: In Spain the closeness of Kinship is measured in grades (grado). Each generation is a grade. The grade series determines the line which can be straight (from ascendants to descendants or vice versa), or “colateral” (elatives that do not descend one from another but belong to a common ascendant).

In the line, as many grades as persons are counted, subtracting one.

In the direct line you are first grade with your parents, second with your grandparents, and third with your great-grandparents.

In the direct line, you are also first grade with your sons or daughters, second grade with your grandchildren, third grade with your great grandchildren.

| You | Parent | Grandparent | Great-Grandparent. |

| first grade | second grade | third grade | |

| You | son/daugther | grandchild | great-grandchild |

In the collateral you count up from the deceased to the common progenitor and then go down to the inheritance tax payer (the person for whom the count is being made). So a brother is therefore two grades from his brother, three from his uncle or aunt, and four from his cousin.

The GROUP is a concept only for inheritance tax purposes. There are four Groups:- And lastly, the Kinship can be by blood or by marriage, the so named “afinidad”, the relationship that marriage creates between a partner and the blood relatives of the other.

- Descendants and adopted younger than twenty one.

- Descendants and adopted over twenty one, widow or widower, parents and grandparents and beyond.

- Inheritors on the “colateral” line, grades two and three, and ascendants and descendants of the spouse or by “afinidad”.

- Inheritors on the collateral line, grade four, more distant grades, and non-related beneficiaries.

– Parentesco por afinidad ( in-laws) is the relationship that links a person with the blood relations of his or her married partner.

A descendant or an ascendant- in- law ( son-in-law or daughter-in-law, parents-in-law) as well as a stepchild is included in the inheritance tax law as kin in Group III.

The collateral blood relations are not included in the law but recent court judgements state that if the law does not distinguish, we must not distinguish either, so brothers, uncles, aunts, nephews and nieces by marriage are also included in Group III, as are the corresponding blood relations.